Jusqu’à 900 $ en rabais voyage ou jusqu’à 800 $ à investir dans un produit financier annuellement*

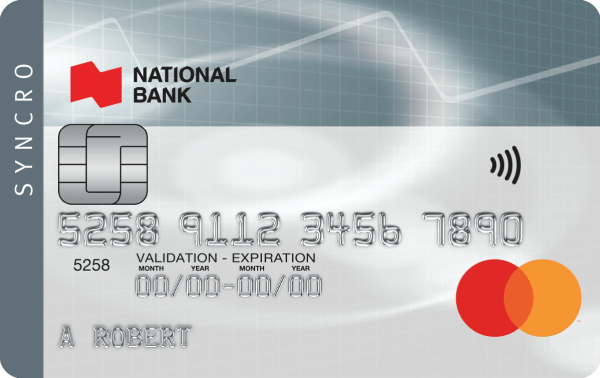

The benefits of our low-interest SyncroTM Mastercard® credit card

Simple admission terms

No minimum annual income required, unlike other credit cards5

Zero liability protection

No liability for unauthorized transactions6

Purchase protection

Up to 90 days after purchase in case of theft or damage1

Adapted limit

Minimum credit limit of $500 which can be increased under certain conditions5

Enhanced security

Online purchases protected by Mastercard® ID CheckTM

Quick and easy payments

Make contactless payments with Apple Pay® or Google Pay®

Enjoy an interest-free period and other useful features

21-day grace period to give you peace of mind

Enjoy a 21-day grace period.7 That means no interest is charged on purchases made during the month if you pay the full amount on your account within 21 days of the statement date.

Different features to make life easier

- Double the manufacturer's warranty1 for up to an

additional year.*

- Protect your account with the

ability to block, unblock, or replace your credit card.

- Receive balance alerts, activate travel alerts, and schedule

pre-authorized payments with no annual fee.

* Maximum coverage of $60,000 for the entire term of the account

This low-interest credit card not what you’re looking for?

* Maximum coverage of $60,000 for the entire term of the account

We’re here for you

Need personalized advice?

Our advisors are here to answer all of your questions

Need additional assistance?

Find all the answers to your questions in our Help centre.