Annual fee

$30

Purchase rate

20.99%

Interest rate (balance transfers and cash advances) 3-4

22.49%

Secure online form

Jusqu’à 900 $ en rabais voyage ou jusqu’à 800 $ à investir dans un produit financier annuellement*

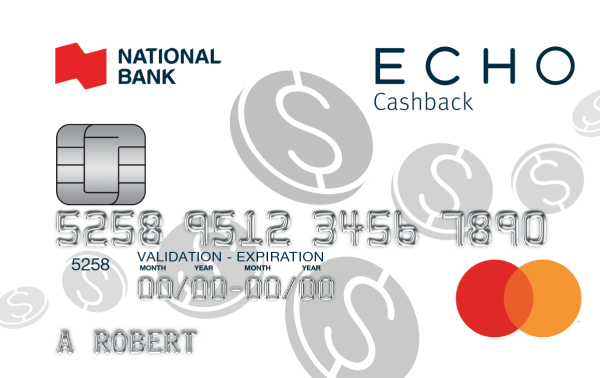

The benefits of your ECHO Cashback Mastercard credit card

Even more benefits

Earn up to 1.5% cashback on gas, groceries, and online purchases1

Extended warranty

Get up to double the manufacturer's warranty for most items purchased using your credit card.5

Purchase insurance

Stay protected against theft or damage for 90 days from the date of your purchase.6

Secure online purchases

Mastercard® ID CheckTM is a service that protects you against fraud by verifying your identity when making online purchases.

Fraud protection

Benefit from Mastercard's Zero Liability policy 7- you won't be liable for unauthorized transactions completed with your card.

Simple admission terms

No minimum annual income required.

Enjoy cashback and useful features

How to take advantage of your cashback?

- Apply online

-

Pay with your card

Earn cashback at a rate of 1.5% on gas, groceries, and online purchases 1 and 1% on all other eligible purchases. -

Use your cashback

Once you earn $10 cashback, sign in to your online bank to apply your cashback to your credit card account.

Features that’ll make life easier

Get a quick response to your application

Apply online from the comfort of your home and get an answer in minutes.

Secure online form

Not the right credit card for you?

Not the right credit card for you?

The National Bank® Platinum Mastercard® credit card may be better suited for you:

- Get up to 2 points per dollar spent on groceries, at

restaurants and when you fill up your vehicle

- Take advantage of travel insurance for up to 10 days

- Get mobile

device insurance

We’re here for you

Want to apply for the ECHO CashBack Mastercard credit card?

Apply online. It’s quick and easy.

Need personalized advice?

Our advisors are here to answer all of your questions

Need additional assistance?

Find all the answers to your questions in our Help centre.